Filing Tips

Optimizing Tax Liabilities: Filing Tips for Individuals and Businesses

Understanding how to optimize tax liabilities can significantly impact your financial well-being. Whether you are an individual or a business, being proactive in managing your taxes can lead to substantial savings. Here are some essential tips to help you navigate the tax filing process efficiently:

For Individuals:

1. Take Advantage of Tax Credits and Deductions

Be aware of available tax credits and deductions that can lower your taxable income. Common deductions include mortgage interest, student loan interest, and charitable contributions. Tax credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit, can directly reduce your tax bill.

2. Contribute to Retirement Accounts

Contributing to retirement accounts like a 401(k) or IRA not only helps you save for the future but can also lower your taxable income for the current year.

3. Plan for Capital Gains and Losses

If you have investments, consider the tax implications of selling them. Offset gains with losses to minimize your tax liability.

For Businesses:

1. Choose the Right Business Structure

The type of business entity you choose (e.g., sole proprietorship, partnership, corporation) can have significant tax implications. Consult with a tax professional to determine the most tax-efficient structure for your business.

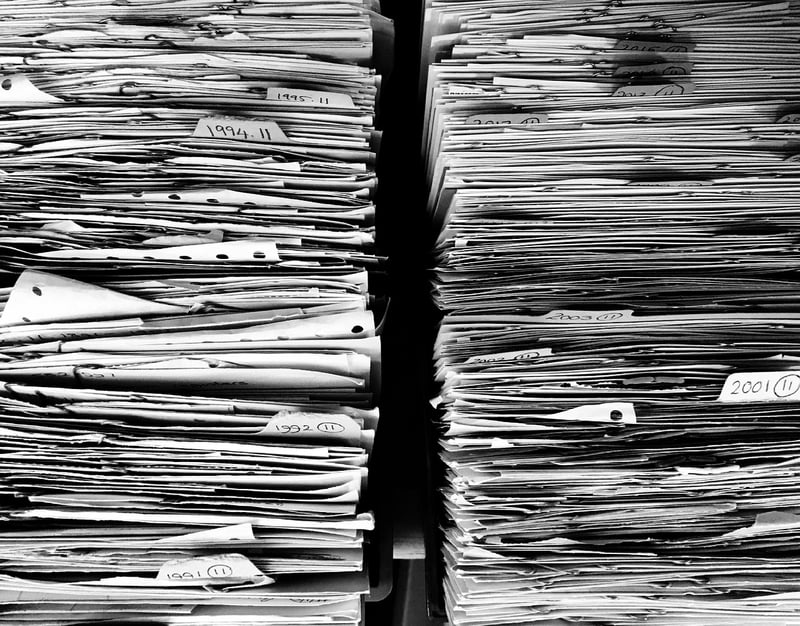

2. Keep Accurate Records

Maintain detailed records of your income and expenses throughout the year. Good record-keeping not only helps you track your financial health but also ensures you are prepared for tax season.

3. Take Advantage of Tax Deductions

Business expenses such as office supplies, travel, and professional services are often tax-deductible. Be sure to keep receipts and documentation to support these deductions.

Additional Tips for Everyone:

1. Stay Informed

Tax laws are constantly changing. Stay informed about updates that may affect your tax situation. Consider consulting a tax professional for personalized advice.

2. File on Time

Missing the tax filing deadline can result in penalties and interest. Ensure you file your taxes on time or request an extension if needed.

By following these tips and staying proactive in managing your tax liabilities, you can optimize your tax situation and potentially save money. Remember, when in doubt, seek guidance from a qualified tax professional.

Disclaimer: This article provides general tips and should not be considered as professional tax advice. Consult with a tax professional for personalized guidance.